KUALA LUMPUR, March 23 — As Ramadan draws to a close in over a week, Muslims are reminded of an important obligation before celebrating Hari Raya Aidilfitri: paying zakat fitrah.

This annual tithe, a religious donation, is intended to help those in need partake in the festive season while also serving as a means of purifying one’s fast.

However, this year, some states have increased their zakat fitrah rates more than others.

What is ‘zakat fitrah’?

One of the six pillars of faith in Islam is to contribute zakat. One form is zakat is the zakat fitrah, which is a mandatory donation that every Muslim must pay before the Aidilfitri prayers begin.

The amount is determined by the price of staple food most commonly consumed in a particular area, such as rice.

In a family, the head of the household, typically the father or husband, is responsible for paying zakat fitrah on behalf of himself and his dependents. This includes his wife, children, and any other individuals under his care who do not have the means to pay on their own.

As a form of almsgiving, zakat fitrah ensures that wealth is shared with the less fortunate, fostering a sense of community and care.

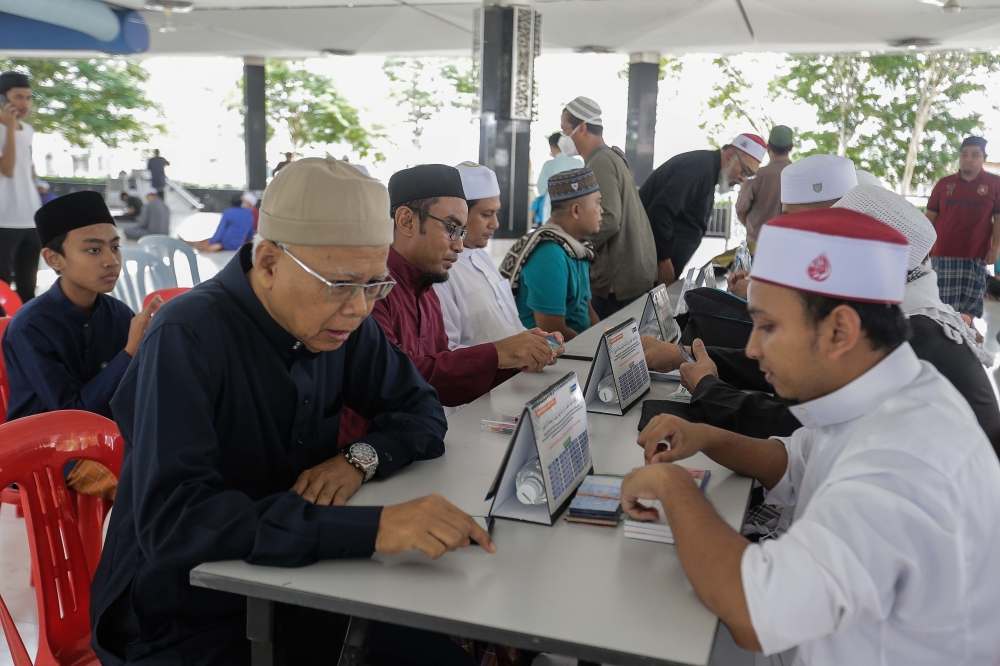

A man is seen paying his ‘zakat’ at the Puncak Alam Mosque March 20, 2023. — Picture by Sayuti Zainudin

Why are there different payment tiers?

The variation in zakat fitrah rates depends on the type of rice consumed according to one’s financial status.

The minimum rate is based on the most commonly eaten rice, but those who consume more expensive varieties are encouraged to contribute a higher amount.

For instance, in Selangor, the 2025 zakat fitrah rates are RM7, RM15, and RM22. The lowest rate applies to those who eat regular local rice, while the higher rates are for those who consume premium or imported varieties, such as basmati or fragrant rice.

Other states follow a similar tiered structure but with different price points. In Perak, for example, the rates are RM10, RM16, and RM27, depending on the type of rice most commonly consumed in the state.

Why did the rate change this year?

Zakat fitrah rates fluctuate because they are directly tied to rice prices, which change annually. The rate is based on one sa’, which was an ancient measurement of volume from the Islamic world. This is equal to roughly 2.6kg of rice.

For instance, Kelantan’s minimum rate has increased from RM7 to RM8, while Perak’s has risen from RM8 to RM10.

In Negeri Sembilan, the state Islamic religious council has adjusted this year’s rates to RM7.50, RM12, and RM22, compared to RM7, RM12.50, and RM22 last year.

Selangor’s minimum zakat fitrah remains at RM7, but the second and third tiers have increased by RM1, bringing them to RM15 and RM22, respectively.

Perak’s revised rates were determined after a study conducted by the state religious authority, which used data from the Ministry of Agriculture and Food Security and the 2024 basic food determination schedule from the National Cost of Living Action Council.

The study found that local rice shortages had led to the introduction of Madani rice, a blend of local and imported rice.

At RM4.10 per kilogram, the price of Madani rice — when calculated for 2.6kg — translates into a zakat fitrah rate of RM10.

Because zakat fitrah payments must equate to the cost of 2.6kg of rice, each state’s religious council reviews rice prices annually and adjusts the zakat rate accordingly.

Sacks of rice displayed for sale at a supermarket in Kuala Lumpur October 16, 2024. — Picture by Firdaus Latif

Malaysia’s rice supply challenges

In recent years, Malaysia has faced a shortage of locally produced white rice, leading to fluctuations in rice prices.

To address this, the government introduced Madani white rice, a category that blends local and imported rice.

A recent study by the Biotechnology and Nanotechnology Research Centre of the Malaysian Agricultural Research and Development Institute (Mardi) found that 50 per cent of 5,000 samples of imported rice seized by authorities contained a mix of local white rice.

Retailers and consumers have also struggled with supply manipulation.

Mydin Holdings managing director Datuk Ameer Ali Mydin, speaking as president of the Bumiputera Retailers Association, recently claimed that local rice millers were hoarding local white rice to manipulate supply.

He alleged that millers were demanding cash payments instead of the usual 30-day credit terms, making it difficult for supermarkets to restock rice.

According to him, suppliers are delivering only 50 to 100 bags per store per week, whereas supermarkets require at least 500 bags daily to meet customer demand.

These disruptions have contributed to rising rice prices in various states, which, in turn, directly impact zakat fitrah rates.

Muslims pay ‘zakat’ at the Puncak Alam Mosque March 20, 2023. — Picture by Sayuti Zainudin

How and where to pay zakat fitrah

Traditionally, zakat fitrah is paid to registered amils, or zakat collectors, who would set up booths at mosques, shopping centres, and other public locations.

In the past, it was more common for people to settle their zakat right before the Aidilfitri prayers since the amil would set up their booths at mosques.

The protocol would see the amil reciting the akad, or declaration, along with the payer, formally acknowledging the transaction with a handshake.

Today, digital platforms have transformed how zakat is paid, especially after the Covid-19 pandemic, which encouraged physical distancing.

Muslims can now fulfil their obligation online via:

- State zakat body websites

- Banking apps

- MyEG and Pos Online

- E-wallet services, such as Boost

Instead of verbally reciting the akad to an amil, users simply tick a box confirming their payment and recite the declaration themselves.

The declaration typically goes as follows:

“The following is the money replacing the fitrah rice amounting to RM7.00, which is obligatory for the person I represent this year for the sake of Allah Ta’ala.”